The definition of life insurance policies the income test assessment of life insurance policies the assets test assessment of life insurance policies and how to assess an insurance bond. Household contents and personal effects.

In terms of asset valuation from Centrelink so a 1 million annuity only counts as 500000.

. They have zero financial value unless you pass away during the policy term. An asset is something you invest in with the hope of receiving a return on your investment. Cash value life insurance can also be a liquid asset if you need to borrow or withdraw from the policy in a pinch.

Their pension entitlement is calculated under the assets test as. Permanent life insurance with its cash value accumulation is considered an asset. A life insurance bond is a product where the investment is paid as a single premium into a life insurance policy with an underlying asset-backed fund.

Gold bullion and other precious metals. Assets are property or items you or your partner own in full or part or have an interest in. I asked a lawyer he said its.

Using a life insurance calculator can help you decide how much coverage you need. You can update your income and assets through you Centrelink online account at any time. When considering life insurance as an asset class the cash value component makes the difference.

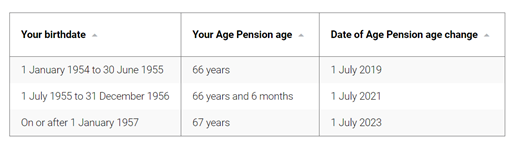

The pension will reduce by 300 per fortnight single or couple combined for each 1000 of assets over the threshold. Assets assessed by Centrelink do not include your home or superannuation provided you are not drawing a. Permanent life insurance policies can build a cash value and may function as an asset.

Death of a Claimant. It remains an asset until such point as it is withdrawn via surrender or maturity. Posted by 3 years ago.

Centrelink can be contacted. Once you decide whether term or permanent life insurance makes more sense you can get life insurance quotes online. Life insurance offices commit to paying a specified minimum benefit on the occurrence of particular events such as the death of the insured.

For example if it is used to pay out the mortgage on a principal home it becomes part of an exempt asset. Assets need to be below the certain amounts to qualify for the full age pension under the assets test. You have 14 days to advise Centrelink of what your mother has done with the funds.

Although the death benefit of a life insurance policy can be considered an asset as it is in the life settlement industry people usually think of the cash value of a policy when thinking of insurance as an asset. This relates to the full range of financial assets including cash management accounts and term deposits. However Centrelink may assess the amount under the income and assets tests depending on what your mother does with the amounts received.

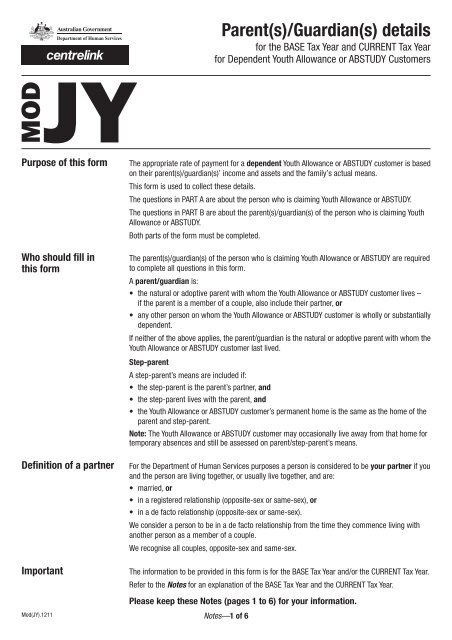

Super Life Insurance vs Centrelink. Summary A persons life insurance policies and insurance bonds MAY be an assessable asset. SS Guide 43920 Income from Life Insurance Products.

Giving away an asset you own jointly with the deceased or get from their estate is. Step 4 98500 x 300 1000 29550. With whole life insurance policies a cash value is accrued which means that policyholders.

Step 2 401500 couple homeowner Step 3 500000 401500 98500. If Helen was only age 63 for example she would. During the term of the policy a life insurance policy is an asset but not a financial asset at this stage and is prima facie assessable only under the assets test.

Can or does Centrelink count the life insurance as an asset and therefore I would not even be eligible for the small Newstart payment they have advised to claimThank You. What effect will a super life insurance payout of 250000 have on a Centrelink DSP payment. This also includes deemed income from pensionsincome streams based on super accumulation accounts and accounts once you reach retirement age.

If the amounts are placed into a bank account then deeming will apply to the value of the bank account. Most people have tangible assets like a home and other valuable items and liquid assets including retirement and savings accounts which you hope gain value over time. The market value of an asset is not reduced by any costs which may be incurred if the asset was to be sold.

Super Life Insurance vs Centrelink. Select your payment or service to find out how this impacts you. Assets test assessment will depend on how the money is used.

A life interest can be the right to income from an asset or the right to the use of an asset for a persons life without the person being the legal owner. If you only have the right to live in a property for life this is not considered income and does not need to be recorded here. Managed investments and superannuation.

The bondholder receives a regular income until the end of the bonds term when the investment the current value of the fund is returned to the bondholder. Surrender value of life insurance policies. Whether a life insurance policy is an asset depends on whether you benefit financially from your policy.

Given away any cash assets personal property or income in the last 5 years. One Partner Eligible Couple Combined. If your policy is considered an asset you may be able to use it as collateral for a loan or sell it or you may have to consider it during divorce negotiations.

They can affect your payment. Other Centrelink Age Pensioner financial assets. Term insurance is not considered an asset but provides valuable benefits.

The Muirfield Team on March 19 2020 at 836 am. 215 Death or Imprisonment of a Claimant. Presumed income from financial assets bank accounts shares of term deposits.

For the purposes of calculating your deemed financial income your financial assets includes any holdings of gold bullion and other precious metals many life insurance policies most superannuation account balances and some funeral bonds. Since term life policies do not have any cash value they are not considered an asset. For Centrelink purposes taxable income includes the following.

Surrendered rights to any cash assets personal property or income in the last five years. Whole life insurance can impact Medicaid eligibility. Motor vehicles boats and caravans must all be declared to Centrelink as an asset when applying for the Age Pension but its not all bad news as cars are not considered financial assets that is an investment that makes you.

Sold any assets personal property for less than their value in the last five years. With the right type of insurance tax-deferred cash value aka savings or equity can accrue and grow as an asset for the policy owner. For a part pension assessable assets must be less then.

Step 1 500000. Step 5 71180 x 2 29550 112810 pf combined or 56405 pf each. This type of permanent life insurance policy provides coverage for the entirety of a persons life and pays out a death benefit to the beneficiaries when the policyholder passes away.

Centrelink works out the pension rates under the income test and the assets test and pays whichever is the lower of the two rates. Collections for trading investment or hobby purposes. Gross income wages and salaries including benefits and.

A life interest is often created via a will. Under the income test financial investments are subject to deeming.

Claim For Australian Pension United States Department Of Human

Robin Hood And Piggy Bank What The Welfare State Does For Us

Your 7 Most Common Centrelink Questions At Retirement Financial Planning Geelong Muirfield Financial Services

Parent S Guardian S Details For The Base Tax Year And Current

Despite Government Rethink Of Centrelink Most Retirees Remain Unable To Connect To Their Wealth Yourlifechoices

When Is Life Insurance An Asset Smartasset

Updating Your Asset Details With Centrelink Invest Blue

Pension Asset Test How Gifting Money To Children Affects Your Age Pension

Centrelink Information Covid19 Kelly Wealth Services

Centrelink Financial Planning Strategies By Financial Framework

When Is Life Insurance An Asset Smartasset

Aon Aon Plc Insurance Learning Bitcoin

When Is Life Insurance An Asset Smartasset

Centrelink Gifting Rules Progressive Financial Solutions

Jdfp Jason Dawson Financial Planning Centrelink Assets Test

Age Pension Income And Assets Tests What You Need To Know Now Starts At 60

/Familybuyingnewcar_skynesher_CROPPED_Eplus_Getty-2a8c993cd0c146da9cdcd5c293f766b2.jpg)