EPF withdrawals post-retirement age of 58 years is completely tax-free. 2020-6-22The Employee Provident Fund Organisation EPFO has provided a social security scheme called the Employee Pension Scheme EPS.

Pf Rule Update Step By Step Guide To Withdraw Epf Money Via Umang App Uan Portal

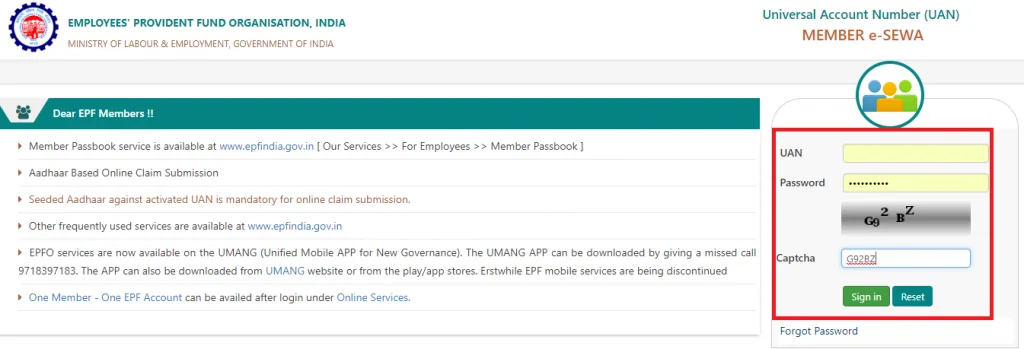

EPFO UAN Login Employee Signin at unifiedportal-memepfindiagovin.

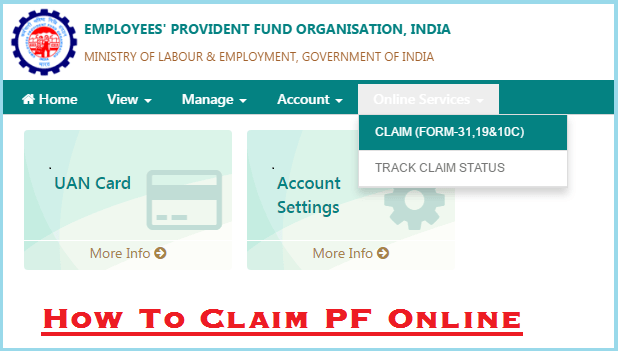

. 2022-9-20KUALA LUMPUR Sept 20. 2022-6-23Now go to the Online Services tab and select the option Claim Form-31 19 10C from the drop-down menu. In case you need to withdraw you will have to fill out a declaration with a specified reason for the same.

Depending on the purpose of withdrawal limits can vary. 2021-5-28There are cases where money is left in inactive EPF accounts or money is not withdrawn from the EPF account after the employee has left the job. 2021-11-23Any advance made under the EPF Scheme is exempt from tax.

2020-8-14If individuals withdraw their EPF after 5 years of employment they are exempted from paying tax. Do read my other sharing on EPF i-Saraan including how to transfer the money through online banking to EPF i-saraan contribution. 2017-8-23The money is tagged to the employees UAN and as she changes jobs only the account details get transferred to the new EPF office.

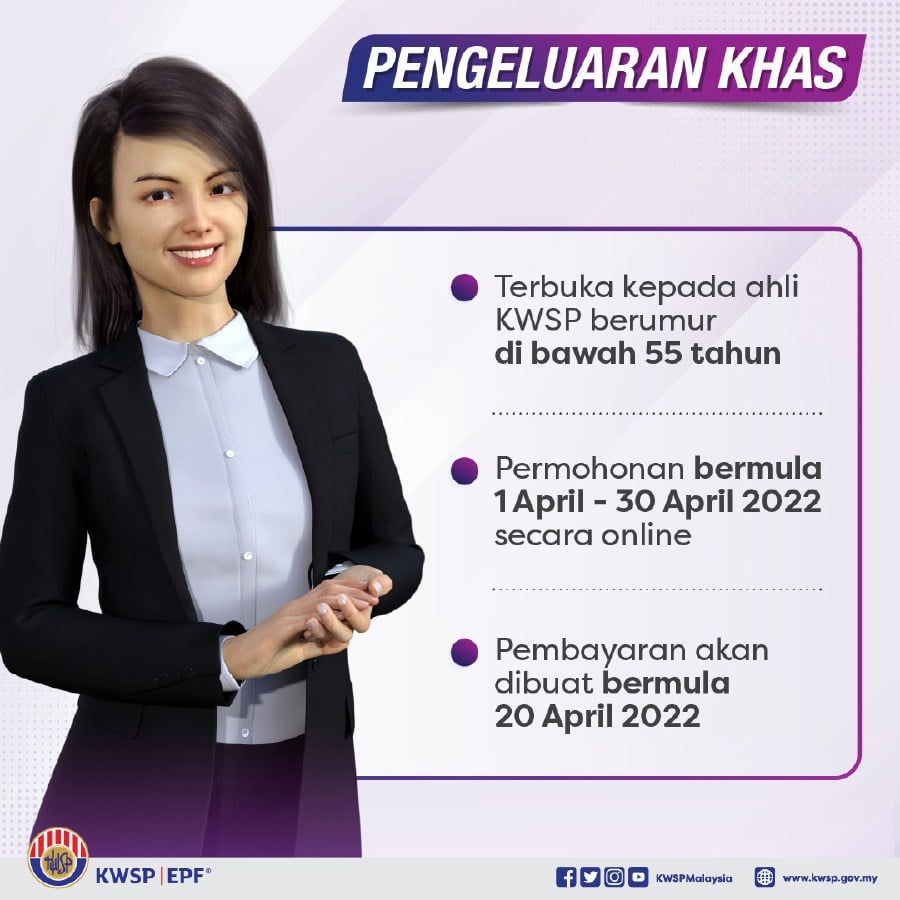

If you do not withdraw the EPF funds post three years of retirement you will have to pay tax on the interest earned. 2022-10-7The Employees Provident Fund EPF had in 2021 recorded its first negative net contribution in 20 years at RM582 billion as members withdrew funds from their EPF accounts to cushion the impact of Covid-19 pandemic movement restrictions which began in early 2020 according to the EPFs chief executive officer Datuk Seri Amir Hamzah Azizan. 2022-9-8PPF is one of the most popular government-backed savings schemes in India because of its guaranteed returns and tax benefits.

PF Withdrawal Forms are therefore those forms through which you can claim the money and these forms differ on the basis of age reason for claiming the withdrawal and if you are in service or not. 2017-5-10The government it seems is pulling out all the stops in making Housing for All by 2022 a success. This scheme makes employees working in the organised sector to be eligible for a pension after their retirement at the age of 58 years.

PPF has a maturity period of 15 years after which you can choose to withdraw funds from your PPF account. 2022-10-18An employee can withdraw up to 50 of his PF amount from his EPF account. There is no physical movement of EPF money he explained.

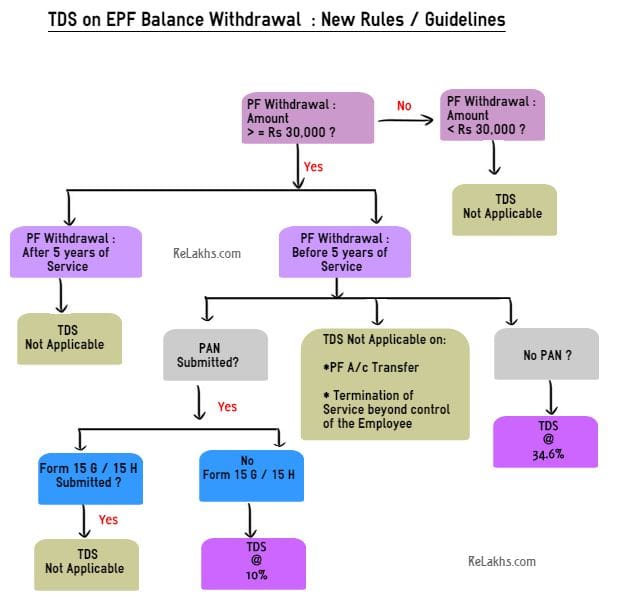

However to be exempted from paying tax for withdrawing EPF before the 5-year period Form 15GH must be submitted. The initiative gets a shot in the arm by allowing members of EPFO ie. The waiting period is 2 months.

EPFO has allowed members ie. Forms as 19 31 and 10 C were used for making. 2017-9-12Any employee who contributes to an EPF account can check the balance in hisher EPF account via online channels.

The total EPF balance includes the employees contribution and that of the employer along with the accrued interest. 2019-8-8As per the latest EPF Withdrawal rules you can withdraw money from your EPF account only if you have no job at the time you apply for withdrawal. The contributory employees of the provident fund PF scheme to use 90.

You can make up to 3 withdrawals from these criteria. Are there any withdrawal limits. 2017-11-11An EPFO Employees Provident Fund Organisation subscriber can take an advance from EPF deposits for specific purposes including purchaseconstruction of house and repayment of loan.

Know rules to withdraw PF amount PF forms how to claim request online. Are there any withdrawal limits for EPF. You can also withdraw partially from your EPF savings for.

Further he will be eligible to get the Employees Pension Scheme amount as. August 8 2020 at 428 pm. News Update 1 st June 2021.

The labour ministry has announced that EPF members can now withdraw twice from their EPF account to meet the emergency expenses arising due to the Coronavirus pandemic. 2022-9-28And members can only withdraw the accumulated contributions in Akaun Emas at age 60. 2019-4-30Ranjekar was an employee of Wipro Ltd and didnt withdraw EPF corpus for nine years after retirement.

2022-9-26In the event of the EPF account holders demise e-nomination enables the nominee or dependents spouse children and parents to withdraw accrued money from EPF Employees Pension Scheme EPS. On the next screen enter your bank account number and click on Verify. The interest on the EPF amount is taxable as per applicable income tax slab rates.

The contributory employees to dip into their retirement savings to own a home of their own. 2022-1-14The provision to withdraw money from EPF accounts was first announced in March 2020 under the Pradhan Mantri Garib Kalyan Yojana PMGKY According to the withdrawal rules EPFO members can take non-refundable withdrawals of up to three months basic earnings and dearness allowance or 75 percent of the EPF account balance whichever is smaller. Partial withdrawals are also allowed before the account matures after the 6 th financial year from account opening but only under certain.

TDS Deduction on PF Account and EPF Saving Tips. Believing that the EPF corpus is tax-free on withdrawal Ranjekar did not declare it in his. To use the service you need to SMS EPFOHO UAN ENG to 7738299899.

An employee can withdraw 75 of outstanding balance in the PF account or three months basic. 2020-11-27Withdrawal of provident fund money for those facing financial stress due to covid-19 is also allowed. An employee can withdraw up to 90 of the PF amount after attaining the age of 54 or one year before the age of superannuation whichever is later.

Know rules to withdraw PF amount PF forms how to claim request online. In a survey conducted by Sun Life Malaysia on retirement the life insurance and family takaful provider found that 4 of respondents admitted that their savings in the Employees Provident Fund EPF accounts no longer have enough amounts to withdrawIn a statement released on Tuesday Sept 20 Sun Life Malaysia said that an. They do not have to wait for the employer to share the Employees Provident Fund EPF statement at the end of the year to know the balanc You can check your EPF balance using any of these facilities.

This Page is BLOCKED as it is using Iframes. 2022-6-26You can use the SMS service to know the EPF balance on mobile. Check ur EPFO EPF Claim Status Online by Missed Call SMS UAN Number at epfindiagovin.

PF member cant withdraw the PF balance after resignation. To know PF balance without UAN sending an SMS will be useful. 2022-7-10In order to withdraw money from EPF or claim money from the same one needs to submit the claim forms.

2022-10-18Epf Withdrawal Forms Download 5 9 10-c 10-d 13 14 19 EPF vs PPF - Employee Provident Fund vs Public Provident Fund. In such cases the EPF account continues to earn interest on the EPF deposits. Soni informs that the interest earned on the deposits lying in inactive EPF accounts are taxable in the hands of an employee.

The waiting period is 2-month. Umang App EPFO Member e-Sewa portal. 2017-11-28According to the Employees Provident Fund EPF Act to claim hisher final provident fund PF settlement one has to retire from service after attaining 58 years of age.

EPFO allows members to withdraw money from EPF Account twice to meet COVID-19 Emergency.

Epf Withdrawal Rule Changed Employees Won T Be Able To Take Out Their Provident Fund Money This Way Anymore Zee Business

Epf Withdrawal Rules How To Withdraw From Epf If You Need Money Due To Coronavirus The Economic Times

Updated Epf I Sinar How To Withdraw Money From Account 1 And What Are The Requirements Iproperty Com My

Epf Withdrawal For House Flat Or Construction Of Property Basunivesh

Provident Fund Withdrawal How To Withdraw Money From Your Epf Account Online

Employee Provident Fund How To Check Epf Balance Online Withdraw Pf Money And More 91mobiles Com

You Can Withdraw 75 Of Employees Provident Fund For Covid 19 Pandemic Soon Check Details The Financial Express

Pf Calculator Your Rs 6 27 Lakh Epf Balance Withdrawal Can Lead To Rs 18 12 Lakh Loss Post Retirement Zee Business

Want To Make Premature Withdrawals From Your Epf Here S When You Can Do It

Pf Withdrawal Rules Epf Withdrawal Status Online Forms Process

How To Withdraw Money From Epf Emplyee Provident Fund Login Account Withdraw Money From Your Epf Account And All The Details Related To Epf Money Withdrawal

Epf Withdrawal Rules How To Withdraw From Epf If You Need Money Due To Coronavirus The Economic Times

How Can You Withdraw Your Epf Funds Online Paisabazaar Com

How To Withdraw Epf Online A Step By Step Guide Zee Business

Pf Money Withdrawal Step By Step Guide To Do It Online Provident News India Tv

How To Withdraw Pf Money In One Hour